.

.

.

.

.

.

.

.

.

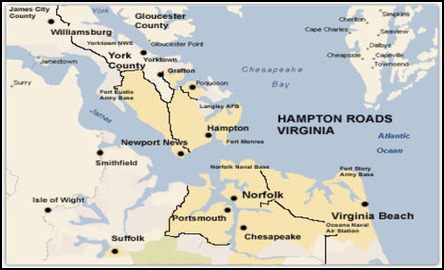

HAMPTON * NEWPORT NEWS * YORKTOWN * NORFOLK * CHESAPEAKE

HAMPTON * NEWPORT NEWS * YORKTOWN * NORFOLK * CHESAPEAKE

PORTSMOUTH * VIRGINIA BEACH * AND THE SURROUNDING AREAS

.

..

This brief video gives an excellent overview on working with a Real Estate Agent to find a home. This agent explains everything very clearly. She happens to be based in California and their terminology is just a little bit different. When she explains the escrow company, she is talking about the Home Closing. And in Virginia you get the keys immediately at the end of closing.

Buying a home is a big decision. It is normal to be a little nervous and unsure about things. But you will find that this can be completely eliminated by simply taking the time to become informed about the process. That is the purpose of this video. And the goal of this website.

.

Interested In Homes For Sale In The Hampton Roads Virginia Area?

Get Free Information And Free Assistance. Search The Realtors MLS

.

This video gives a very good overview of the home loan process. If you are wanting to own your own home then one of the very first questions that needs to be answered is “How Am I Going To Pay For It?” This is why you constantly here about “Getting Pre-Qualified”. A lot of the confusion in buying a home can be completely eliminated by understanding the Mortgage process. That is the purpose of this video. And the goal of this website.

It is very important to keep in mind that there are two separate things happening when buying a home. On one hand you are working with a real estate agent to search for homes and completing all of that paperwork. As explained in the first video. Then you are working with a bank, credit union, or mortgage company, etc. Doing all of their paperwork to get approved for the money to pay for the home. As explained in the second video.

The two are closely related because obviously you would not be doing one if you were not also doing the other. But they are two completely separate things. And many people find it much easier, less stressful, and extremely beneficial, to complete a lot of the loan process first! And then start working with a real estate agent to find a home!

..

Home Buying Information Seems To Be Everywhere. But Real Estate, And Mortgage, Professionals Across The Country Continue To Say The Very First Thing They Must Do is Educate Buyers About The Process. Including Correcting Mis-Information They May Have. That Is The Purpose Of This Website. And These Two Videos..

.

Our Real Estate Group helps hundreds of people looking to buy a home. And existing homeowners who need to sell their home. And for over 20 years we have helped many families, couples, and individuals, just like you buy homes in Hampton Roads.

Many of whom never thought they would be able to own their homes!

We provide Free Home Search tools, and assistance with the entire buying, or selling, process from beginning to closing. Plus, our company provides

FREE HOME BUYER HELP TIPS. Sign Up Below. Even those who may have felt they could not own a home due to past credit problems.

For Instance: Did you know that if you’ve had a past bankruptcy that is at least 18 months to 2 years old, there are finance programs available that may allow you to buy a home right now! This is the kind of information that we can assist you with.

..

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

PENINSULA HOMES REAL ESTATE LLC

809 Aberdeen Rd. #9001 Hampton VA 23670

Phone: 757-838-4663 Fax: 757-299-9900

WE HELP PEOPLE BUY, AND SELL, HOMES

.